How to Search Alabama Property Records

Property records in Alabama show ownership, mortgages, liens, and legal descriptions for real estate across the state. Alabama uses a decentralized system where each of the 67 counties keeps its own records at the local Probate Court. There is no central state database. The Judge of Probate in each county records deeds, mortgages, plats, and other property documents. Alabama law requires all conveyances to include the grantor's marital status. A preparer statement must appear on every recorded document. The Real Estate Sales Validation Form is mandatory for all property transfers. Many counties now offer online searching, but access methods vary across the state.

Alabama Property Records Quick Facts

What Are Alabama Property Records?

Property records document who owns land and buildings. They serve as the official public record. These are legal documents that show ownership histories and any claims against real estate. Each record becomes permanent once filed with the Probate Court.

Alabama property records include several types of documents. Warranty deeds transfer ownership with guarantees from the seller. Quitclaim deeds pass whatever interest the grantor holds. Mortgages secure loans against property. Liens record claims for unpaid debts. Plats show subdivided lots with measurements. Easements grant rights to use portions of property.

Other recorded documents include releases and satisfactions of mortgages, judgments, powers of attorney, and UCC filings. The county maintains indexes by grantor name, grantee name, and property description. This helps you find records even if you only know one detail.

Who Keeps Property Records in Alabama?

Alabama uses a unique system. The Judge of Probate in each county maintains property records. This differs from most states that use Recorder of Deeds offices. All 67 counties operate independently. No statewide database connects these local systems.

The Probate Court records and indexes all property documents. Staff process incoming recordings daily. They maintain both physical and digital records. Historical documents often exist on microfilm. Many counties have digitized records going back decades. Mobile County holds records from 1813. That was before Alabama became a state.

County Revenue Commissioners handle property tax assessments. They determine values for taxation purposes. Tax Assessors maintain separate records of appraised values. These offices work with Probate Courts but remain distinct. Property owners deal with both offices for different needs.

Cities handle building permits and zoning only. Property deeds stay with the county. If you need a deed or mortgage record in any Alabama city, go to the county Probate Court.

How to Search Property Records in Alabama

Visit the county Probate Court in person for the fastest service. Bring your ID and know the property address or owner name. Staff can help find records in their index systems. Public computer terminals exist in many courthouses.

Search online where the county offers it. Over 50 counties have some online access. Create an account on the county portal. Search by name, address, book and page number, or date range. View index results for free in most systems. Pay per page to view or download actual documents.

Request records by mail by writing to the Probate Judge. Include the property address, owner names, and document type. Send a check for expected fees. Include a self-addressed stamped envelope for return.

Use e-recording for new documents. Approved vendors include Simplifile and CSC. Electronic filing speeds processing time. Documents typically record within one to two business days. Jefferson, Mobile, Clarke, Covington, Coffee, Walker, Lauderdale, and Jackson counties accept e-recording.

Alabama Property Records Fees

Recording fees vary by county. Most charge between $3 and $16 for the first page. Additional pages typically cost $3 each. Names beyond the first two grantors and grantees add $1 per name. Certified copies cost $2 to $5 depending on the county.

Transfer taxes apply to most property conveyances. Deed tax equals $0.50 per $500 of property value. Mortgage tax runs $0.15 per $100 of the loan amount. Two-thirds of these taxes go to the state. One-third stays with the county.

Online access fees differ across counties. Some offer free searching and viewing. Others charge $0.10 to $2 per page for document images. Subscription plans exist for frequent users. Monthly rates range from $10 to $125 depending on the county and access level. Madison and Tuscaloosa counties offer free online access.

Alabama Property Records Laws

Alabama Code Title 35 Chapter 4 governs property conveyances. Section 35-4-50 requires recording in the Probate office. Section 35-4-60 guarantees public access to record books during office hours. The Probate Judge must let anyone view records and provide copies for lawful fees.

Section 35-4-73 mandates disclosure of marital status on all deeds. False statements are a misdemeanor. Section 35-4-110 requires a preparer statement with name and address on every recorded document. The Section 35-4-74 says instruments need a plat, plat book reference, or metes and bounds description.

Transfer taxes fall under Title 40 Chapter 22. Section 40-22-1 sets deed tax rates. Section 40-22-2 establishes mortgage tax rates. The Electronic Recording Act under Section 35-4-123 authorizes digital filing where counties choose to offer it.

Property records remain public in Alabama. Anyone may view them during business hours. The Probate Judge must provide certified copies upon payment of fees. No privacy rules apply to recorded property documents.

Search Alabama Property Records Online

Many counties provide online searching through their portals. Jefferson County uses Landmark WEB with records back to 1987. Mobile County offers the same system with documents from 1813. Madison County gives free searching through CountyGov Services. Tuscaloosa County maintains free access to probate records.

Most Alabama counties use the Ingenuity platform at ingprobate.com or altags.com. This covers over 40 counties. Search by name or document type. Some require a login. Others let you search without an account. Document images may cost extra.

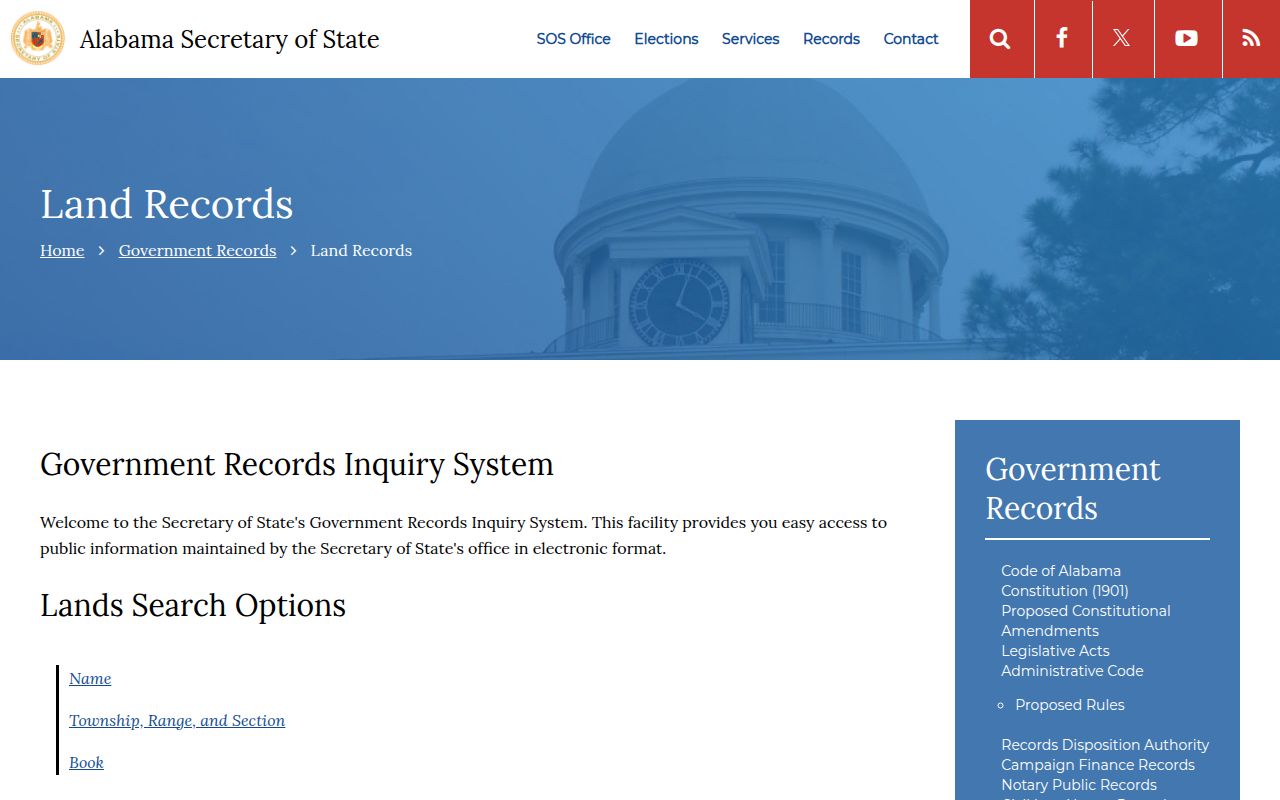

The Alabama Secretary of State hosts historical land records at sos.alabama.gov. Search patents from 1800 through 1950 by name or legal description. This covers the original land grants before counties kept their own records.

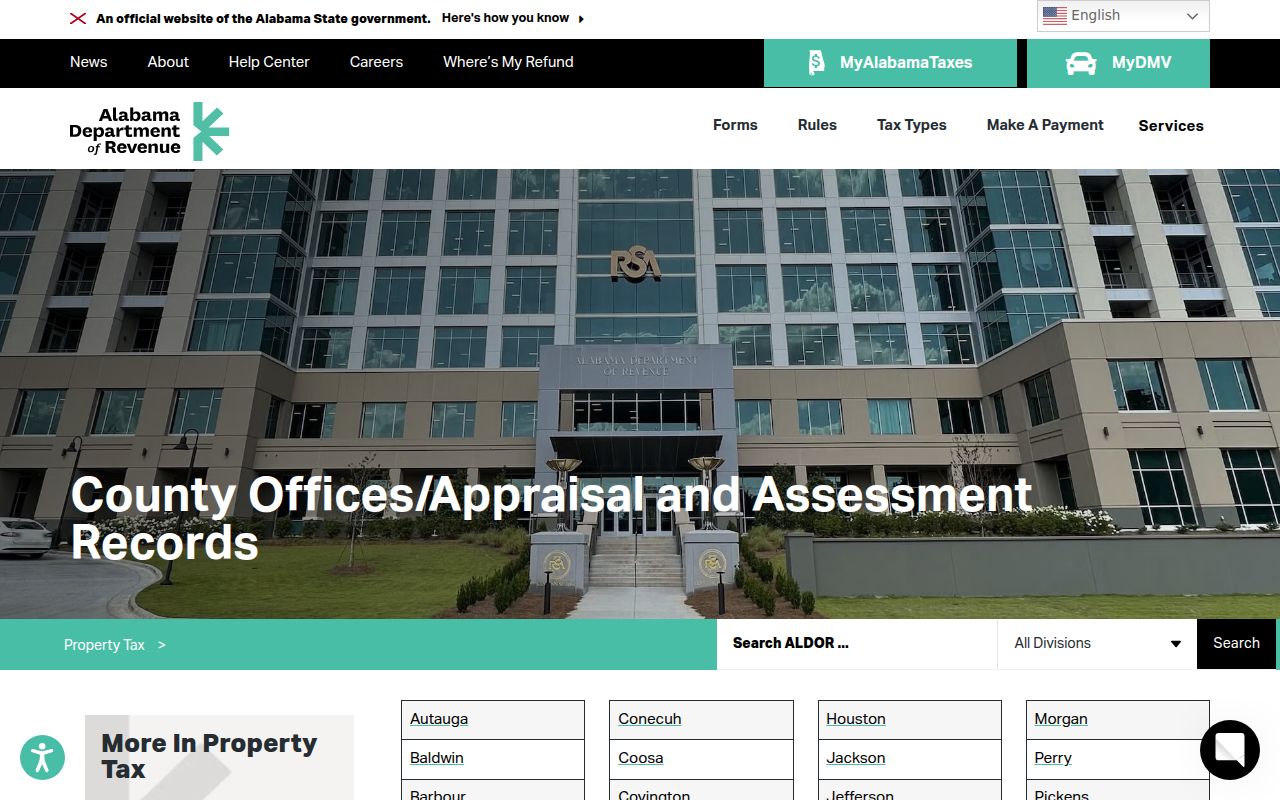

The Alabama Department of Revenue links to all county tax offices at revenue.alabama.gov. Each county listing includes GIS mapping and property search portals. Use this as a starting point to find your county's online system.

Third-Party Record Systems

Several vendors provide record access for Alabama counties. Ingenuity Inc. runs the most common platform. Access through ingprobate.com or altags.com depending on the county. This covers deed and probate records for over 40 counties.

Landmark WEB from GovOS serves Jefferson and Mobile counties. This is the most advanced system in Alabama. Search indexes free after creating an account. Pay per page for document images. Both counties have records going back decades.

Capture CAMA handles tax and appraisal data for many counties. Syscon Online provides property data for several more. Flagship GIS at alabamagis.com offers parcel mapping across multiple counties. Each system has its own search method and fee structure.

Browse Alabama Property Records by County

Each of the 67 Alabama counties maintains property records at the local Probate Court. Pick a county below to find contact info, fees, online access details, and local procedures.

Property Records in Major Alabama Cities

City governments do not maintain deed or mortgage records in Alabama. However, these major cities have significant property activity. Select a city to learn which county handles its records.