Access Fayette County Property Records

Property records in Fayette County are kept at the Probate Court in Fayette. The Judge of Probate serves as the official recorder of deeds, mortgages, liens, and other property documents. Fayette County is part of the 24th Judicial Circuit and has a population of about 16,000. The Probate Court records and indexes all property transfers, mortgage filings, and related documents. Public access to these records is guaranteed under Alabama Code Section 35-4-60. You can search records online, by mail, or in person at the courthouse. Recording fees and transfer taxes apply to all new filings.

Fayette County Quick Facts

Fayette County Probate Court

The Probate Court maintains all property records for Fayette County. The office handles recording of deeds, mortgages, liens, plats, and other land documents. Staff can help you search records and make copies. The courthouse is in Fayette.

Visit during regular business hours to search records or file documents. Most Probate Courts open at 8:00 AM and close at 4:30 PM on weekdays. Call ahead to verify hours since they can vary. The office closes on state holidays.

Bring your ID when you visit. Know the property address or owner name before searching. Staff maintain index books and computer systems to help locate records. Most offices have public terminals for self-service searching.

| Office | Fayette County Probate Court |

|---|---|

| Location | Fayette, Alabama |

| Hours | Monday through Friday, 8:00 AM to 4:30 PM |

How to Search Fayette County Property Records

You can search property records in Fayette County online or in person. Each method works for different needs. Online access lets you search from anywhere. In-person visits work best when you need certified copies right away or want help from staff.

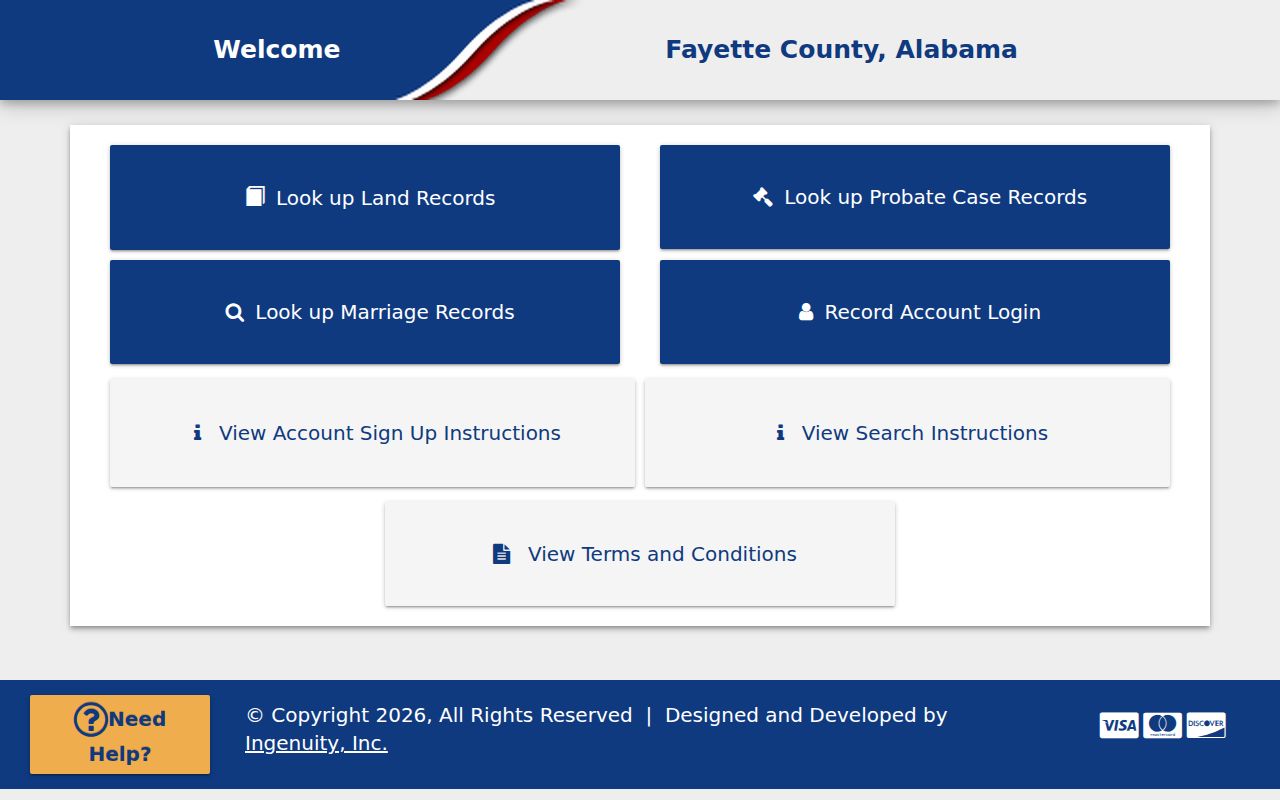

Online records are available through ingprobate.com. The system lets you search by owner name, document type, or recording date. Index results may be free to view. Document images often require a small fee per page. Create an account to save searches and track documents over time.

Search options in Fayette County include:

- Grantor and grantee name searches

- Document type filters (deeds, mortgages, liens)

- Date range searches

- Book and page number lookups

- Legal description searches

Visit the Probate Court in person for the most complete search. Staff can access records not yet online. They can also help interpret older documents or confusing index entries. Bring cash or a check to pay for copies.

Request records by mail by writing to the Probate Judge. Include the property address, owner names, and document type you need. Send payment for expected fees. Add a self-addressed stamped envelope for return. Mail requests typically take one to two weeks to process.

Fayette County Recording Fees

Recording fees in Fayette County follow state guidelines with some local variations. The fee schedule applies to all documents filed at the Probate Court. Contact the office to verify current fees before submitting documents.

Standard recording fees include:

- First page of any document: $3 to $16

- Each additional page: $3

- Extra grantors or grantees beyond two: $1 each

- Plat or map recording: $15 per page

Transfer taxes add to the cost of deeds and mortgages. Deed tax equals $0.50 per $500 of property value (0.1%). Mortgage tax runs $0.15 per $100 of the loan amount. The state receives two-thirds of these taxes. Fayette County keeps one-third.

Copy and search fees:

- Regular copies: $0.50 to $1 per page

- Certified copies: $2 to $5 per document

- Search assistance: varies by complexity

What Fayette County Property Records Show

Property records in Fayette County document real estate ownership and encumbrances. Each recorded document becomes part of the permanent public record. Anyone can view these records during business hours.

Deeds show property transfers between parties. A warranty deed provides guarantees about clear title. A quitclaim deed transfers only whatever interest the grantor holds. All deeds must include the grantor's marital status per Alabama Code Section 35-4-73. The legal description identifies the exact property boundaries.

Common document types in Fayette County include:

- Warranty deeds and quitclaim deeds

- Mortgages and deeds of trust

- Mortgage releases and satisfactions

- Mechanic's liens and judgment liens

- Easements and right-of-way agreements

- Subdivision plats and surveys

- Powers of attorney for property

Property records are public in Alabama. Alabama Code Section 35-4-60 guarantees access to record books during office hours. You do not need to be a party to the transaction. The Probate Judge must provide copies for the lawful fee.

Related Records in Fayette County

Other county offices maintain records that relate to property. The Revenue Commissioner handles property tax bills and payments. The Tax Assessor determines property values for taxation. These offices work with the Probate Court but operate separately.

Check with the Revenue Commissioner for tax lien information. Unpaid taxes can result in liens against property. The Tax Collector's office handles tax sales when owners fail to pay. These records help complete the picture of a property's status.

GIS and mapping offices provide parcel information. Use these resources to identify property boundaries before searching deed records. Many counties offer online GIS maps that show ownership, lot lines, and other details.

Cities in Fayette County

All cities and towns in Fayette County record property documents at the county Probate Court. City governments handle zoning and building permits but not deed or mortgage recordings.

Major cities in ${county.name} County file property records with the Probate Court in ${county.seat}.

Nearby Counties

These counties border Fayette County. Verify which county your property is in before searching. Some areas near county lines may require checking both counties.